The Demographic Challenges for the Social Security System

Social Security systems in industrialised nations have been built on the basis of different demographics than what we are facing today. A recipe for disaster.

Contribution scheme

There will be less people paying in to the social security systems due to the demographic shift.

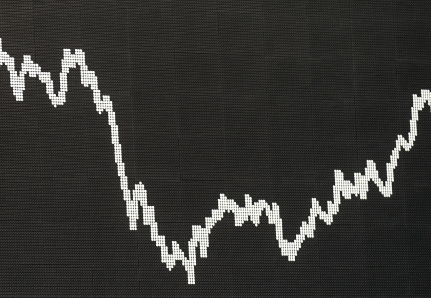

Rising deficit

As people are living longer, the average cost per person on social security will increase.

Public finances

The demographic shift acts as a main driver in unsustainable financial development of social security systems.

In the past, countries built social security systems for different population statistics than now. This mismatch could lead to problems. As more people around the world live longer, our communities are changing.

This has a significant impact on the systems we have in place, like social security. Junoverse is aware of these shifts and is helping organisations understand and deal with these new challenges.

CONTRIBUTION SCHEME

Demographic Pressure

We are seeing more older people leaving and fewer younger ones entering the workforce. Social security systems rely on contributions from young workers to support benefits for older individuals. This poses a challenge for these systems. Organisations can use Strategic Age Management to change their ways and keep older employees working longer.

Evolving Work Paradigms

Our work methods are also undergoing transformation. More people are doing temporary or freelance jobs, and they often do not pay into the social security system. To handle this, embracing Workforce Agility means making our systems inclusive for people who work more flexibly.

With fewer people contributing, systems relying on young workers’ money for older people’s social security are in jeopardy.

By using Workforce Longevity strategies to retain older workers, we can prevent a decrease in income for the system.

RISING DEFICIT

Benefit Payouts

As people live longer, they need social security benefits for more years. This means the social security system has to pay out more, which can be exceedingly expensive. If we can help older people stay healthy and working, they will not need to rely on social security as much. Non-Financial Retirement programs provide additional support, reducing the amount of money the system needs to pay out.

Economic Volatility

In the wake of economic downturns, social security systems suffer because people earn and pay less into the system. Risk Technology can help by predicting these problems before they happen, so we can try to fix them and keep the system stable.

Unplanned Costs

Significant events, such as natural disasters, pandemics or shifts in age demographics, can disrupt the system’s equilibrium. Welfare Technology can help us be ready for these changes and deal with them quickly.

PUBLIC FINANCES

Diverted Resources

When we have to use money for social security that would be needed in other fields, it can slow down progress in those important areas. Good strategies, such as Operational Risk strategies, help us use our resources wisely and not neglect other important needs.

Taxation Pressures

Raising taxes may seem like a good way to get more money for social security. However, it can be complicated and cause a lot of disagreements. Private companies can collaborate with the government through CSR and ESG initiatives for social responsibility. This way, they can help fund social security without putting too much pressure on taxpayers.

Sure, social security has some significant challenges because of our aging population, but we can overcome them. Everyone involved can work together to build a social security system that is strong and can last into the future. This can be achieved this by studying the workforce, using Technology for Ageing, and creating Age-Friendly Workplaces. Junoverse is there to help show the way in a world where being able to change is exceedingly important.